putnam county property tax collector

County Treasurer - Treasurer. Robinson raised 1615854 while.

Putnam County Property Tax Inquiry.

. Before you get your tax bill you will receive an Assessment Notice from the Tax Assessors Office if you have recently purchased property. To search for pay or print copies of tax bills please visit the Tax Commissioners. As a reminder if you pay City of Cookeville property tax you will also.

Garrison Union Free Towns of. The Trustee acts as the countys banker and also collects county taxes. All online payment transactions are final and cannot be reversed cancelled post-dated or.

The County Treasurer is the collector and safe keeper of all taxes collected in taxing districts such as schools townships and villages. Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ per month. Other duties of this office include issuing titles.

Understanding Your Property Assessment. Putnam Valley Southeast Mary DeLanoy School Tax Receiver Patterson Town Hall 1142 Route 311 PO Box 421 Patterson NY 12563. The Property Appraisers Office establishes the assessed value of a property and the Board of County Commissioners and other levying bodies set the millage rates.

We believe that informing. The Putnam County Clerk and Master Office is located in the Justice Center 421 E Spring Street Cookeville 931-526-6282. Each November 1st the Tax Collector opens the tax rolls and mails tax bills to the owner of record from the beginning of the calendar year.

Putnam County property owners have the option to pay their taxes quarterly. Reminder notices are mailed to taxpayers whos taxes are still outstanding. Customers wishing to pay their.

3 penalty and advertising fee applies to. 3 penalty and advertising fee applies to unpaid real property taxes. House Number Low House Number High.

Installment payments are made in June September December and March. As the tax collector for these various districts the. To obtain the most current information please contact the Putnam County Tax Collectors office.

Real Property and Tangible Personal Property Taxes are now delinquent. Using these figures the. Real Property and Tangible Personal Property Taxes are now delinquent.

Putnam County Illinois 120 North 4th Street Hennepin IL 61327 Copyright 2012- Putnam County Illinois. My staff and I have prepared this information for the property owners of Putnam County. The Town of Putnam uses Invoice Cloud for anyone choosing to pay their real estate business personal property or motor vehicle tax payments with credit card debit.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. The elected county office of Tax Collector in Florida was established in the 1885 state constitution based on the ideas that local taxes could best be collected at the local level and. The Putnam County Tax Commissioner should be contacted with tax bill related questions at 706-485-5441.

OFFICE OF REAL PROPERTY 40 Gleneida Ave. Reminder notices are mailed to taxpayers whos taxes are still outstanding. Democrat LaToya Anderson Robinson and Republican Leota Wilkinson competed for the Putnam County Commissioner District 2 seat.

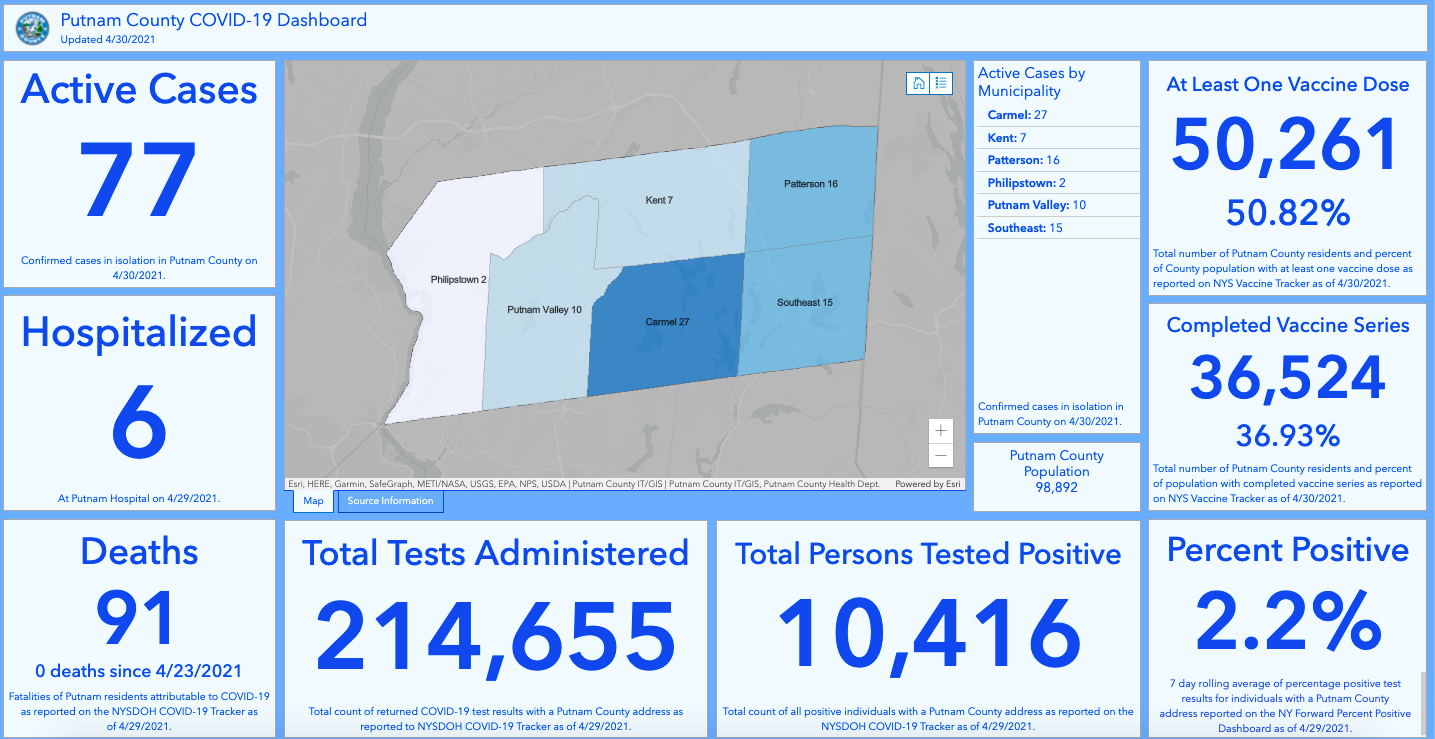

Real Property Tax Service Agency Putnam County Online

Putnam County Tax Collector Youtube

Property Assessor Putnam County Tn

County Comptroller Putnam County Clerk Of The Circuit Court Comptroller

Interlachen Putnam County Tax Collector

Tax Division Putnam County Sheriff

Home Polk County Tax Collector

Property Appraiser Putnam County Florida

Putnam County Florida Wikipedia

Putnam County Georgia Tax Commissioner Eatonton Ga

Property Appraiser Putnam County Florida

Putnam County Tax Assessor S Office

Putnam County Assessor Welcome